- calendar_month March 19, 2025

- folder U.S. Economy

What you need to know to start your day

By Lou Hirsh | CoStar News | March 18, 2025 | 12:38 P.M.

Housing construction starts rebound

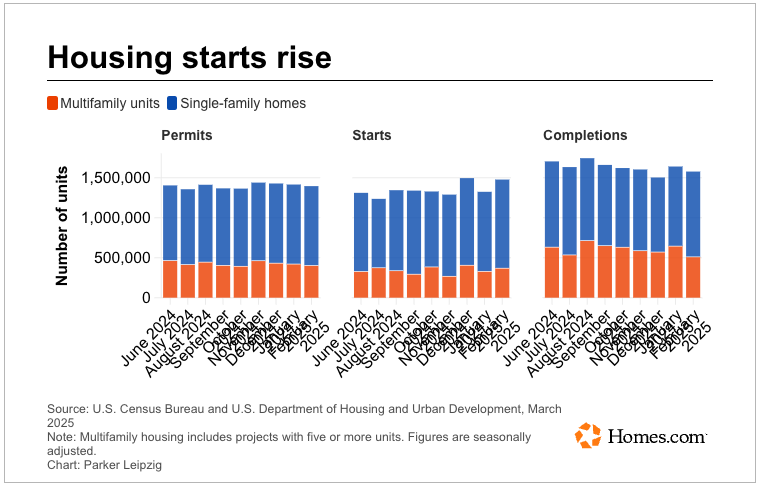

Residential construction starts posted a significant increase in February, thanks largely to the single-family category, though analysts cautioned that builders are still struggling with elevated material costs and shortages of qualified labor.

Total U.S. single-family and multifamily starts increased 11.2% from the prior month to 1.5 million units, according to seasonally adjusted annual figures released Tuesday by the Commerce Department and the Department of Housing and Urban Development. Single-family starts rose 11.4% as multifamily starts increased 10.7% from January, though total residential starts were still 2.9% below the February 2024 level.

“While solid demand and a lack of existing inventory provided a boost to single-family production in February, our latest builder survey shows that builders remain concerned about challenging housing affordability conditions, most notably elevated financing and construction costs as well as tariffs on key building materials,” Buddy Hughes, chairman of the National Association of Home Builders, said in a statement Tuesday.

The trade group is forecasting single-family starts to remain essentially flat for the rest of 2025, with prospects for a more builder-friendly regulatory environment expected to be offset by uncertainty caused by tariffs on crucial building materials, such as steel and lumber.

Odeta Kushi, deputy chief economist at title services provider First American, noted that building material costs are now 40% higher than pre-pandemic levels, making construction more expensive and cutting into builder sentiment even before recent tariffs went into effect.

“Unfortunately, in the near term, given what we’ve seen with the deterioration in home builder sentiment, the rebound could be short-lived,” Kushi told reporter Paul Owers of Homes.com, a sister site to CoStar News, regarding February’s construction trends.

Google to buy tech startup Wiz for $32 billion

Google announced Tuesday that it signed a definitive agreement to acquire cloud security startup Wiz for $32 billion in what would be the largest acquisition in the tech giant’s history.

Google, part of Mountain View, California-based Alphabet, said it expects the all-cash deal to close in 2026, subject to regulatory approvals. A Google statement said New York-based Wiz will become part of its cloud technology and service business, as it seeks to bolster its cybersecurity offerings.

Google’s prior largest acquisition was its 2012 purchase of Motorola Mobility for about $12.5 billion. Wiz last year decided against what was reported to be a proposed $23 billion acquisition by Google as it sought to pursue its own initial public offering, though the IPO market has slowed since 2022.

Tech consolidations have also slowed in recent years, though high-profile deals included Google’s $2.1 billion acquisition of Fitbit in 2021 and Microsoft’s $68.7 billion purchase of video game maker Activision Blizzard in 2023.

Industrial production jumps

U.S. industrial production posted a significant increase in February, though analysts said the uptick could be short-lived as the effects of new and pending trade tariffs take hold.

The latest Federal Reserve data issued Tuesday showed higher than expected growth was posted in areas such as transportation equipment and auto manufacturing. Using 2017 as a base of 100 and gauging factors such as industrial production and capacity utilization, the Fed’s February industrial index posted at 104.2, more than a full point higher than December’s 103.2 and also topping January’s 103.4.

But analysts said the data has yet to reflect newly imposed tariffs on imported goods from Mexico, Canada and China, with other reciprocal tariffs affecting more countries’ products scheduled to take effect April 2.

“The latest wave of tariffs are the 25% duties on steel and aluminum imports,” Bernard Yaros, lead U.S. economist at Oxford Economics, said in a statement Tuesday. He said February’s prime industrial production drivers are “unlikely to sustain the same strength into the coming months,” and the industrial economy likely won’t recover fully until 2026, as the effects of interest rates and tariffs fade.

Yaros noted aerospace production is now above its level prior to last year’s Boeing strike, but transportation equipment has been a source of volatility and auto production faces material and other challenges from the ongoing trade war.