- calendar_month March 18, 2025

- folder U.S. Economy

By Randyl Drummer | CoStar News | March 17, 2025 | 2:48 P.M.

What you need to know to start your day

Trump plans housing on public land

The Trump administration announced its first steps toward fulfilling a campaign pledge to transfer or lease federal lands to states or local governments for development of affordable housing.

Department of Housing and Urban Development Secretary Scott Turner and Department of the Interior Secretary Doug Burgum on Monday announced plans to create a joint task force that would identify public lands where affordable housing could be built, and streamline the process to transfer the properties for housing use.

Much of the more than 500 million acres of federal lands managed by the Interior Department's Bureau of Land Management is suitable for residential use “to increase housing supply and decrease costs for millions of Americans,” Turner and Burgum said in an op-ed in the Wall Street Journal.

Overlooked rural and tribal communities would be a focus of the joint agreement aimed at investing “in America’s many forgotten communities,” the two secretaries said in the op-ed that was also published on the Housing and Urban Development website.

Under the plan, HUD would pinpoint where housing needs are most pressing and work with state and local officials to sell or lease the land. The Interior Department would identify locations that can support housing and help ensure that projects don't get held up with regulatory reviews, “while carefully considering environmental impact and land-use restrictions,” Turner and Burgum said.

In the western U.S., up to 3 million new housing units could be built by unlocking roughly 0.3% of Bureau of Land Management property, equal of about 850 square miles, to help restore housing affordability, according to the Washington, D.C.-based American Enterprise Institute.

Retail sales tick higher

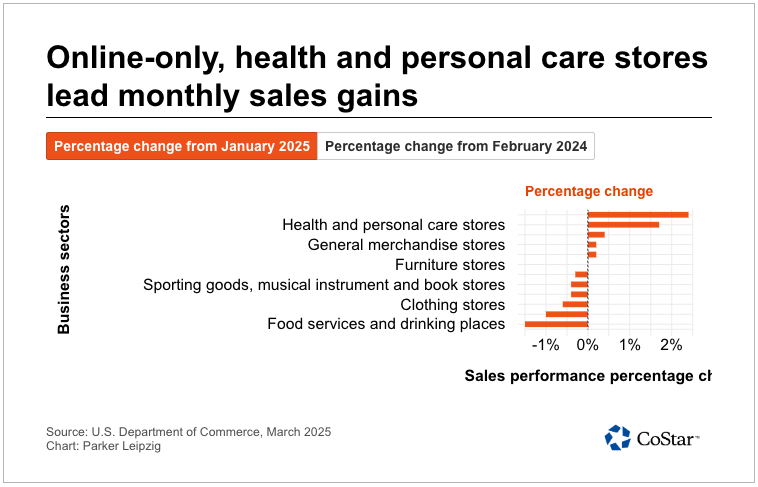

U.S. retail sales ticked higher in February even as consumers appeared to rein in discretionary spending amid uncertainty over the economy.

Overall retail sales in February were up 0.2% month-over-month and up 3.1% year-over-year, compared with a decrease of 1.2% month-over-month and an increase of 3.9% year-over-year in January, according to a monthly report released Monday by the Commerce Department.

The rise in sales reported by the government comes after the National Retail Federation and CNBC last week estimated that total sales, excluding automobiles and gasoline, would fall slightly by about 0.2% in February from January. The NRF’s monthly report is considered a preview of the Commerce Department’s monthly numbers on U.S. retail and food service sales.

While the latest numbers showed a modest increase in February, consumers are still worried about inflation, trade tariffs and other federal policy decisions, National Retail Federation Chief Economist Jack Kleinhenz said in a statement about the latest report.

“Lower-than-expected consumer spending in the first couple of months of the year likely reflected payback for very strong spending in the fourth quarter and weather-related events since then,” Kleinhenz said. “Moreover, these results show that households are apprehensive and carefully navigating lingering inflation and turmoil related to changing economic policies."

Despite the softer spending, retail sales remain healthy so far this year, supported by low unemployment, steady income growth and other improvements in household finances, Kleinhenz added.

Policy group cuts growth outlook on trade concerns

The Organization for Economic Cooperation and Development cut its U.S. and global growth forecast for the year, pointing to mounting signs of weakness linked to lingering inflation, trade wars and other geopolitical tensions.

The Paris-based organization said annual growth in the U.S. economy is projected to slow to 2.2% this year and 1.6% in 2026. The OECD previously projected that the U.S. economy would grow 2.4% in 2025 and 2.1% next year.

Global growth is projected to slow from 3.2% in 2024 to 3.1% this year, and 3% in 2026, with "higher trade barriers in several G20 economies and increased geopolitical and policy uncertainty weighing on investment and household spending,” the organization said Monday in its latest Economic Outlook report.

In its previous outlook, released in December, the OECD estimated 3.3% global economic growth in both 2025 and 2026.

While the global economy has shown resilience, “increasing trade restrictions will contribute to higher costs both for production and consumption," Mathias Cormann, the organization's secretary-general, said in a statement. Free trade "remains essential to ensure a well-functioning, rules-based international trading system and to keep markets open,” Cormann added.