- calendar_month March 17, 2025

- folder U.S. Economy

Sharing Tags

Consumer Sentiment, Current Real Estate, Daily Roundup, Industry, New Car, Small Business

By Lou Hirsh

CoStar News

March 16, 2025 | 2:13 P.M.

Consumer, small business confidence drop

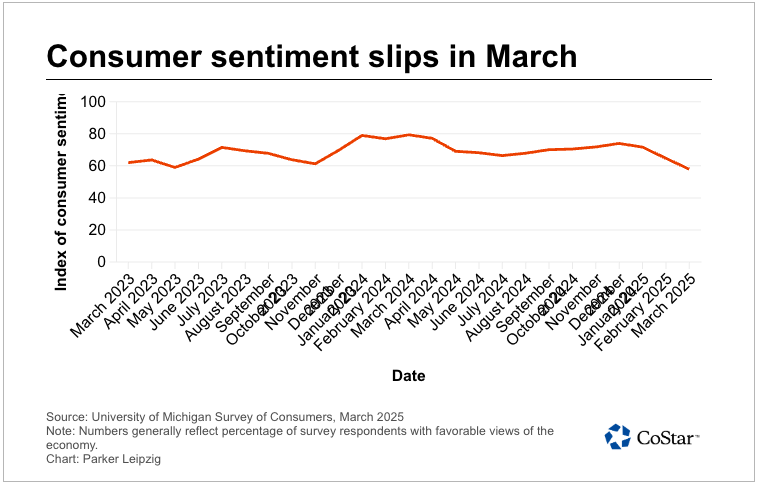

The latest national surveys showed both consumer and small-business confidence flagging in response to stock market volatility and prospects for higher prices generated by international wrangling over U.S.-imposed trade tariffs.

The closely watched University of Michigan survey of consumer sentiment posted at 57.9 for March, down from 64.7 in February and well below the 79.4 for March 2024, based on preliminary numbers reflecting the percentage of respondents with favorable views of their household finances and the larger economy. Based on several metrics, this marked the third-consecutive month of decline in sentiment.

“While current economic conditions were little changed, expectations for the future deteriorated across multiple facets of the economy, including personal finances, labor markets, inflation, business conditions, and stock markets,” Joanne Hsu, the university’s director of consumer sentiment, said in a statement. “Many consumers cited the high level of uncertainty around policy and other economic factors; frequent gyrations in economic policies make it very difficult for consumers to plan for the future, regardless of one’s policy preferences.”

Similar concerns surfaced in the latest survey by the National Federation of Independent Business trade group, showing small business optimism posting at 100.7 for February. The Washington, D.C.-based group’s tracking is based on several metrics including sales, profits and planned hiring, with numbers above 100 indicating prospects for business growth over the next six months.

NFIB researchers said this marked the fourth-consecutive month above the 51-year average of 98, but it was also a drop of 2.1 points from January and 4.4 points below the most recent peak of 105.1 in December 2024.

“Those small business owners expecting better business conditions in the next six months dropped and the percent viewing the current period as a good time to expand fell, but remains well above where it was in the fall,” NFIB Chief Economist Bill Dunkelberg said in a statement. “Inflation remains a major problem, ranked second behind the top problem, labor quality.”

The NFIB said 12% of owners in the latest survey said now is a good time to expand their business, down 5 percentage points from January and the largest monthly decline since April 2020. The percentage of owners expecting the overall economy to improve in the next six months was 37%, down 10 points from the prior month’s survey.

New car affordability rises as tariff fallout looms

Industry data firm Cox Automotive said new-vehicle affordability has improved to its highest level since the summer of 2021, though other analysts warned price hikes are likely ahead as production costs rise as a result of new U.S. tariffs imposed on imported steel.

The latest March report from Cox and data firm Moody’s Analytics, based on data gathered in February, showed it took 39 weeks of median U.S. household income to buy an average new vehicle, a 4.5% lower time span than a year earlier. Researchers noted vehicle prices were 1% lower in February 2024, but interest rates were higher.

Cox also reported that approval rates for auto loans rose 10 basis points in February from the prior month, contributing to an overall improvement of 3% in auto credit access compared with a year earlier. The data firm reported that February’s pace of new-vehicle sales increased 13.6% from January and nearly 6% from a year earlier, though Cox said much of the new sales could be tied to consumer efforts to buy ahead of expected price hikes down the road.

Several analysts and auto executives have warned of price hikes resulting from enacted and pending U.S. tariffs on steel, aluminum and related automaking materials from Canada, Mexico and China.

“Consumer confidence took a hit in February amid news cycle chaos, including tariff threats and rising prices, leading to the lowest level of vehicle purchase plans since last February,” Cox researchers said in a statement. “While concerns about future price increases may be driving more customers to the showroom, uncertainties in policy changes are creating challenges for automakers as they await further information.”