- calendar_month July 16, 2024

- folder Commercial Real Estate

In June 2024, the commercial real estate market experienced mixed performance across different sectors. Here's a snapshot:

- Office Sector: The office sector continued to face challenges with high vacancy rates. Nationally, vacancy rates hovered around 19.2%, approaching historic peaks. However, there is potential for repurposing some older office spaces into apartments or data centers (J.P. Morgan | Official Website) (Baton Rouge Business Report).

- Industrial Sector: Industrial properties, particularly those related to cold storage, performed well. While there are signs of moderation due to decreased post-pandemic demand, the long-term outlook remains positive with consistent rent growth expectations (J.P. Morgan | Official Website) (SP Global).

- Retail Sector: Neighborhood retail centers showed resilience, driven by the demand for brick-and-mortar stores despite the growth of e-commerce. Quick-service restaurants and auto-related businesses were particularly active. However, certain retail segments, like car washes, saw a decline (Baton Rouge Business Report).

- Multifamily Sector: Multifamily properties remained strong, supported by high demand and stable vacancy rates around 5%. However, there was a noted decline in luxury apartment occupancy, leading to rent reductions and concessions (J.P. Morgan | Official Website) (SP Global).

- Market Challenges: Across the board, the market faced challenges from sticky inflation, elevated interest rates, and insurance issues. Transaction volumes and deal velocities were generally lower compared to the previous year, reflecting a cautious market sentiment (Baton Rouge Business Report) (SP Global).

Below please read the blog written by the Crexi Team that goes into detail for each sector.

The Crexi Team | July 12, 2024

Welcome to the June 2024 release of our Crexi Trends report. We analyze Crexi's database each month to identify relevant activity and patterns and share key insights with our users.

Our report showcases trends across Crexi's commercial property listings in June, evaluating average price per square foot, search behavior, occupancy, and other noteworthy metrics. With this information, we aim to arm principals, tenants, and brokers alike with actionable learnings to make well-informed commercial real estate decisions.

Overall National Sales Trends

What the Data Says

- Overall average asking price rose 1.94% in June, continuing a 2-month trend of elevated asking prices and representing a second consecutive month of assets hitting their highest-ever asking price on Crexi’s platform.

- Average occupancy rates rose as well, up 133 basis points to hit 79.96% average occupancy of new listings added to Crexi in June.

Asset Type Trends

Key Takeaways

- The industrial sector's average asking price for new listings jumped impressively in June, up over 8% compared to the previous month. Interestingly, the average occupancy for the asset class dropped from over 70% to 64.7%, with lower occupancy signifying a potential higher ROI or value-added opportunities recently hitting the market.

- The average asking price per square foot of new multifamily assets showed some corrections in June, breaking its 3-month streak of pricing gains.

- Office and retail asking prices stayed relatively stable, rising less than 2% respectively in June from the previous month, with a notable 5% rise in average occupancy for office listings in particular, likely driven by continued interest in Class A assets in prime markets.

- The corrections observed in the multifamily sector suggest a stabilization in the market after a period of rapid price increases, potentially due to market saturation or adjustments to align with current demand and economic conditions.

Overall National Leasing Trends

What the Data Says

- Overall, annual asking rates per square foot barely budged on Crexi in June, inching less than 0.25%. This indicates a continuing hold in the rental market, where rates haven’t moved more than 2% since October 2023.

- We also observed a second consecutive month of more for-lease properties hitting the market, with the most notable supply growth in offices as landlords added 7.36% more listings in June compared to the previous month.

Asset Type Trends

Key Takeaways

- Land asking rates represented the most noticeable rent increases, rising by about 5% from the previous month. This significant increase suggests strong demand for land, potentially driven by development opportunities or other market factors that are making land a more attractive investment.

- Both the industrial and restaurant sectors experienced slight market corrections, adjusting for demand. The industrial sector, in particular, saw a surge of new supply hitting the market, which may have led to these adjustments. These corrections could indicate a response to changing market conditions and the need to balance supply with current demand levels.

Regional Breakdown

What the Data Says

- Less busy in the summertime, buyers and tenants alike were less actively searching for properties in specific markets, with search volume down in major metros across the board.

- Houston, Chicago, and Dallas were the top three markets attracting the most buyer interest, whereas Los Angeles displaced Dallas as the third-most-popular metro for actively searching tenants.

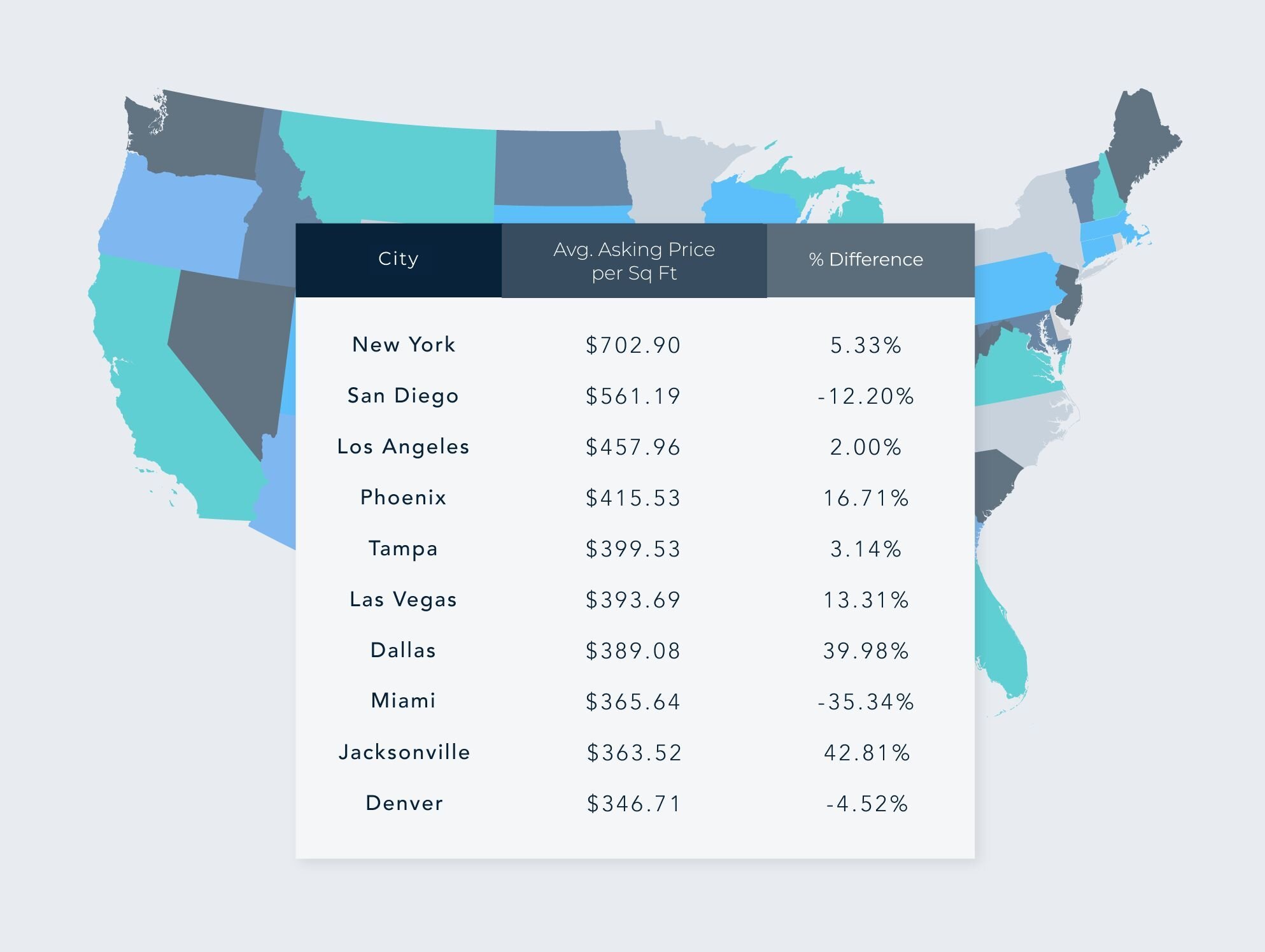

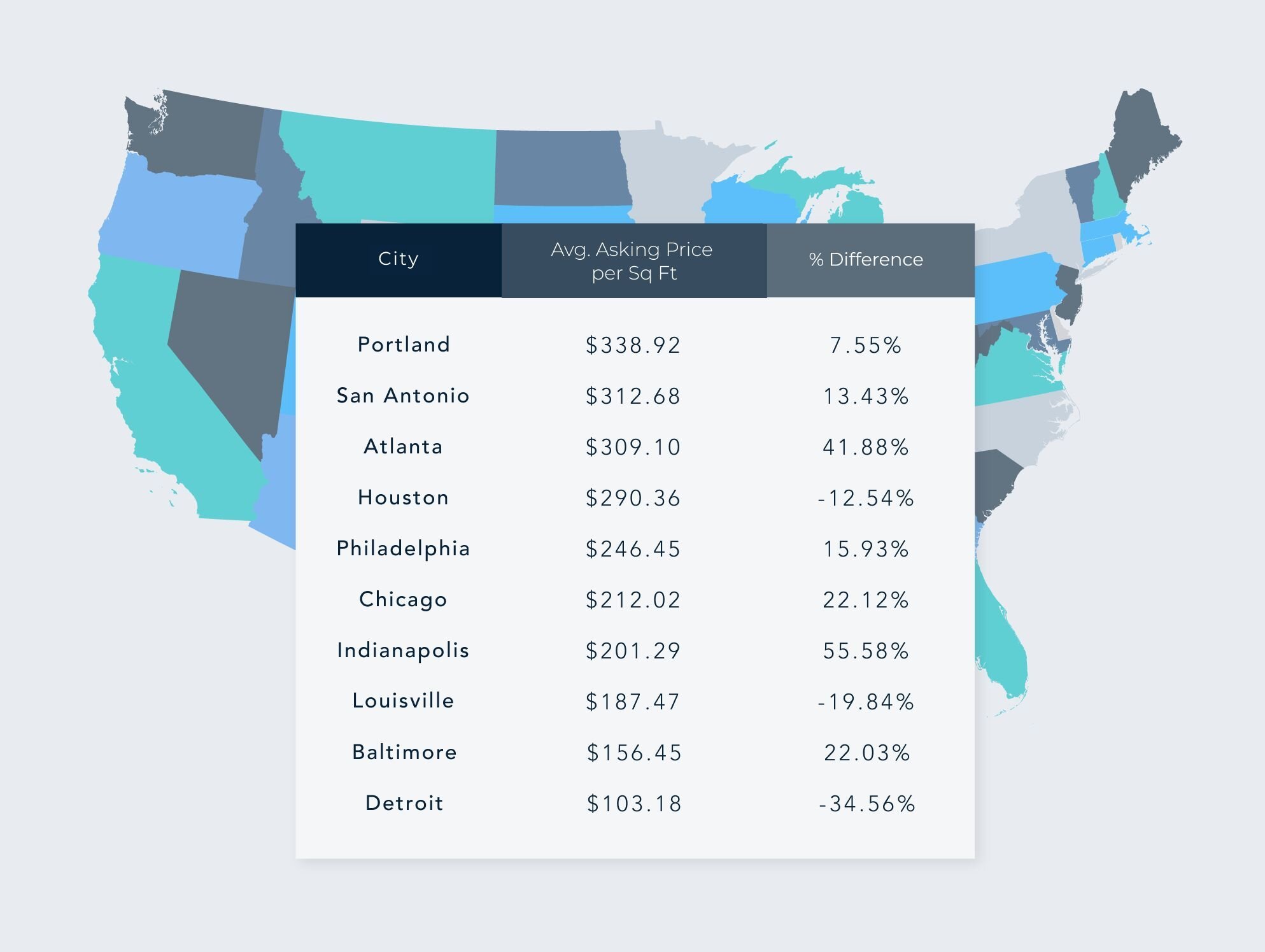

Highest Asking Price by MSA — June 2024

Disclaimer: This article's information is based on Crexi's internal marketplace data and additional external sources. While asking price in many ways reflects market conditions, variations in pricing are affected by changes in inventory, asset size, etc. Nothing contained on this website is intended to be construed as investing advice. Any reference to an investment's past or potential performance should not be construed as a recommendation or guarantee towards a specific outcome.

Overall, while certain sectors showed signs of resilience, the commercial real estate market in June 2024 remained under pressure from economic uncertainties and sector-specific challenges. Please feel free to reach out to me for more details.