- calendar_month February 20, 2024

- folder Current Real Estate

Buying a residential property or a commercial property involves different considerations, as they serve distinct purposes and have unique characteristics. Here are some major differences between the two:

Intended Use

Residential Property: Primarily used for living purposes. It includes single-family homes, multi-family homes (usually up to 4 units), condominiums, townhouses, etc.

Commercial Property: Designed for business purposes. This can include office buildings, retail spaces, industrial warehouses, hotels, and more.

Income Generation

Residential Property: Typically does not generate income unless it is rented out. Homeowners may earn rental income if they choose to lease part or all of their property.

Commercial Property: Generally, the primary purpose is income generation through business activities. Commercial property owners earn rent from tenants who use the space for their businesses. If you are an owner-user of commercial space, it means that you own the property and also operate your own business within that space. In this scenario, the property is serving both as an asset for potential appreciation and as a functional space for your business operations. While you may not be receiving external rental income from other tenants if you are occupying the space 100%, there are still financial implications and potential benefits.

Lease Terms

Residential Property: Residential leases are usually shorter in duration, often 1 to 12 months, with the option to renew. Lease terms for individual tenants are generally more standardized.

Commercial Property: Lease terms are typically longer and more negotiable, often ranging from 3 to 10 years or even longer. Lease agreements for commercial properties are often more complex and tailored to the specific needs of the business.

Property Management

Residential Property: Management responsibilities often fall on the homeowner or a property management company. Maintenance and tenant-related issues are common concerns.

Commercial Property: Property management can be more involved, especially for larger properties. Responsibilities may include tenant relations, building maintenance, and ensuring the property meets zoning and safety regulations.

Zoning and Regulations

Residential Property: Zoning regulations primarily focus on the type of residential use, density, and building codes for safety and habitability.

Commercial Property: Zoning regulations are more varied and can be stricter. Zoning laws may dictate the types of businesses allowed, parking requirements, and other factors that impact commercial use.

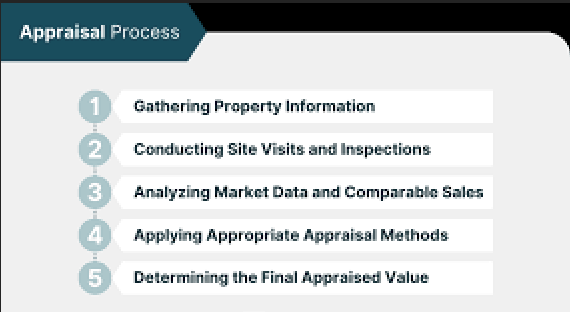

Valuation Methods

Residential Property: Valuation is often based on comparable sales in the area, considering factors like size, location, and condition.

Commercial Property: Valuation is more complex and may involve income capitalization (evaluating the property's income potential), cost approach (estimating the cost to replace the property), and sales comparison.

Financing

Residential Property: Financing is typically more straightforward, with a variety of mortgage options available to individual buyers.

Commercial Property: Financing may involve more extensive due diligence, and lenders often consider the income-generating potential of the property, the financial health of tenants, and the overall market conditions.

Risk and Return

Residential Property: Generally considered lower risk, with steady but relatively lower returns compared to commercial properties.

Commercial Property: Involves higher risk and potentially higher returns. Market conditions, tenant stability, and economic factors can significantly impact commercial property investments.

Before purchasing any property, it’s crucial to carefully weigh the financial considerations, including the initial investment, financing, maintenance costs, and potential appreciation. Additionally, consider your personal or business long term needs and whether owning the property can still provide various financial and operational advantages as key asset for your personal portfolio or business. So it's important to conduct thorough research, consider your investment goals, and seek professional advice from real estate agents, attorneys, CPA/Accountant, and/or financial advisors to ensure a well-informed decision based on your specific needs and objectives.

Please don't hesitate to contact us, as we are here to assist you on this journey.