- calendar_month January 31, 2024

- folder Generational Wealth

11/26/23 12:00 PM ET

Catering to millennials in the realm of real estate involves a nuanced approach, considering their unique preferences and financial considerations. My success in connecting with this demographic lies in understanding their tech-savvy nature, emphasizing digital communication, and leveraging online platforms for property discovery. By offering tailored solutions, such as flexible financing options and highlighting sustainable features, I've facilitated their journey towards homeownership. Recognizing the importance of social and environmental values to millennials, I've fostered trust and engagement, ultimately contributing to successful home purchases within this dynamic demographic. This article written by Ashleigh Jackson, a national content producer for the Nexstar Media Wire elaborates the differences between millennials and how they stack up financially.

Millennials are often stereotyped as lazy, entitled, and less wealthy than baby boomers. But the younger generation is not uniformly worse off, a new study claims.

They are, however, facing a widening wealth gap.

“The wealthiest millennials now have more than ever, while the poor are left further behind,” said the study's lead author Rob Gruijters, an associate professor of education and international development at England’s University of Cambridge.

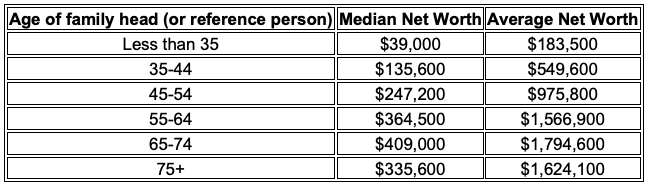

Here's the average Net Worth of Americans by age:

Source: The Federal Reserve’s 2023 Survey of Consumer Finances

Millennials in their mid-30s are more likely to work low-paying service jobs and live with their parents, researchers found, but those with affluent middle-class lifestyles often have more wealth than boomers did at the same age.

The study, published in the American Journal of Sociology in September 2023, examined the work and family life trajectories of more than 6,000 boomers and 6,000 millennials in the U.S. It compared how these life decisions impacted their wealth by the time they turned 35.

Researchers from the University of Cambridge in the UK, Humboldt University in Germany, and Sciences Po University in France analyzed data from the National Longitudinal Survey of Youth, a program of the U.S. Bureau of Labor Statistics, for the study.

Here are some of their key findings:

- Wealth: Millennials at the 90th percentile of wealth distribution in the U.S. possessed about 20% more wealth than boomers did at 35 ($457,000 vs. $373,000). However, the median millennial had 30% lower wealth than the median boomer at that age ($48,000 vs. $63,100).

- Career: Boomers were more likely to land high-status jobs, like lawyers or surgeons. Around 17% of boomers moved into “prestigious” career paths after graduating college, whereas just 7.3% of millennials did so.

- Homeownership: About 62% of boomers had become homeowners by 35, contrasting with the 49% homeownership rate among millennials at that age. Additionally, 10% of millennials lived with their parents at 35, compared to only 6% of boomers.

- Marriage: Millennials tended to postpone marriage. Approximately 27% of boomers got married and had children earlier, while only 13% of millennials followed a similar path.

- Debt: Millennials were also more likely to be in debt: 68% held any kind of debt at 35, compared to 43% of boomers.

- Net worth: About 14% of millennials had negative net worth by 35, which means their debts exceeded their assets, compared to only 8.7% of boomers.

Researchers claim the distribution of wealth among millennials is so uneven because the economic rewards for middle and upper-class lifestyles have increased, while those for the working class have either remained the same or declined.

“Individuals with typical working class careers, like truck drivers or hairdressers, used to be able to buy a home and build a modest level of assets, but this is more difficult for the younger generation,” said Gruijters.

According to the National Association of Realtors, the median age of first-time home buyers in today’s market is 36 — the oldest since the agency started collecting this specific data in 1981.

The NAR said that even though millennials are currently the largest American generation, they saw a “shrinking share” of buyers in the housing market last year. The agency said low inventory, high interest rates, and rising home prices are factors that could turn away potential buyers.

As for the wealth gap, researchers said progressive measures like wealth taxation, universal health insurance, a higher minimum wage and access to stable housing may help tighten it.

“We need to make it easier for those who are currently being left behind to accumulate wealth in the first place,” said study co-author Anette Fasang, a professor of microsociology at Humbolt University. “A slow and tentative approach won’t suffice. Significant action is needed to build a more equal society, where more people can experience some form of prosperity.”

Ashleigh Jackson, national content producer for the Nexstar Media Wire