- calendar_month April 24, 2023

- folder Generational Wealth

Why it pays to buy a house: Homeowners became 40 times wealthier than renters in the past decade

Swapna Venugopal Ramaswamy, USA TODAY

Published 9:00 a.m. ET April 18, 2023 | Updated 12;24 p.m. ET April 18, 2023

Over the past decade, the median-priced home in the U.S. gained $190,000 in value, making the typical homeowner 40 times wealthier than if they had remained a renter, according to a new report.

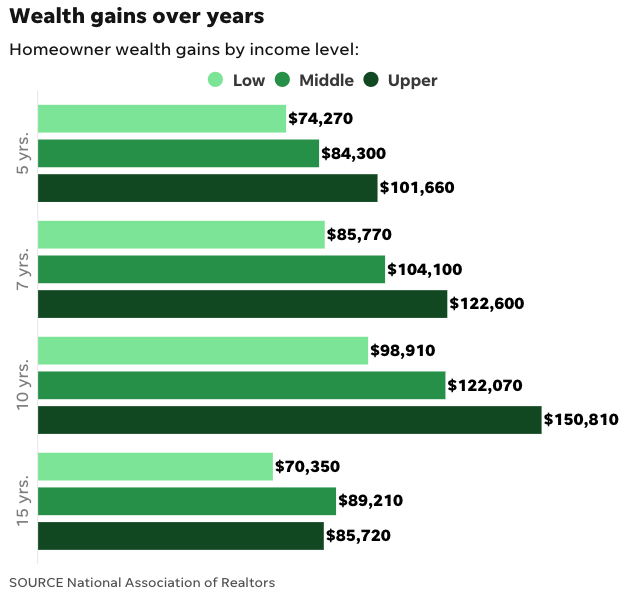

Low-income homeowners (those earning no greater than 80% of the area median income) built $98,900 in wealth while middle-income (those making more than 80% but less than 200% of median area income) and upper income (those earning more than 200% of median area income) homeowners accumulated $122,100 and $150,800 in wealth respectively, according to a report released Tuesday by the National Association of Realtors.

“Over a long time of period, home ownership is a solid path towards building wealth,” says Lawrence Yun, chief economist for National Association of Realtors, told USA TODAY. “It works in two ways: First you have the advantage of home price appreciation, and second, it forces homeowners to save for monthly mortgage payments which renters don’t have.”

In the top 10 areas with the highest homeownership rates for middle-income households, owners gained $110,000 in wealth on average in the past 10 years. In Ogden, Utah, for example, with 85% of the middle-income households owning their home, homeowners have built nearly $220,000 in wealth in the past decade.

Where did low-income earners gain the most wealth through homeownership?

In the San Jose metro area, low-income owners accumulated nearly $630,000 in the past decade, and middle-income owners gained $643,000. All of the top 10 areas with the largest wealth gains for low-income owners – surpassing $290,000 – were in California.

Among all segments of income and race, the wealth gain was smaller over the past 15 years compared with the past 10 years, reflecting the loss of equity when people bought at the peak of the housing crisis in 2007.

In the areas with the highest homeownership rates for low-income households, wealth gains were $140,000 on average.

Rich Americans on a spending spree: It may help US avoid a recession this year

In Prescott, Arizona, where more than 2 out of 3 low-income households (68%) own their own home, owners have built more than $200,000 in wealth in the past decade. Barnstable Town, Massachusetts, as well as the Florida metro areas of North Port, Port St. Lucie, Palm Bay and Deltona, were other areas where most low-income households owned their home and accumulated a substantial amount of wealth – more than $120,000 – in the past decades.

But because of low affordability, the homeownership rate for low-income households in the top 10 areas with the largest wealth gains was lower than the national level at 42% on average. In contrast, in the areas with the highest homeownership rates for low-income households, wealth gains were $140,000 on average.

Homeownership and wealth building by race

While Black homeowners experienced the smallest wealth gains among any other racial or ethnic group, they accumulated more than $115,000 in wealth in the past decade.

Black households in Bellingham, Washington; Ocala, Florida; Palm Bay, Florida; Modesto, California; Greeley, Colorado; and Charleston, South Carolina, were among the areas where more than 60% of Black households own their home. Owners in these areas were able to accumulate more than $125,000 in wealth in the past decade.

Asian homeowners accumulated the most wealth gains in the past decade, followed by Hispanic Americans. While Asian households own more expensive homes than any other group, Hispanic homeowners saw faster appreciation than white homeowners.

Asian and Hispanic Americans also tend to live on the East Coast and West Coast, where prices appreciated more, Yun says.

Hispanic Americans were the only demographic to see eight years of steady homeownership growth, according to census data.

Homeownership rates among income groups

Among the 200 largest metro areas across the country, 38% of these areas had a homeownership rate for low-income households higher than 50%.

The homeownership rate for low-income households varied from 27% to 73%, while the homeownership rate for middle-income households ranged from 47% to 86%.

Ocala, Florida (73%) had the highest homeownership rate for low-income households in 2021, followed by Prescott, Arizona (68%) and Barnstable Town, Massachusetts (67%). Ocala, Florida, Prescott, Arizona, and Salinas, California, were the areas with the smallest homeownership rate gap between low- and middle-income households.

The top three areas with the highest homeownership rates for middle-income households were Barnstable Town (86%), Ogden, Utah (85%), and Port St. Lucie, Florida (83%).

Swapna Venugopal Ramaswamy is a housing and economy correspondent for USA TODAY.